Company reports record 2017 financial results

- Full year net revenues increased 1.8% to a record $2.8 billion

- National Networks delivered record distribution revenue of $1.4 billion, an increase of 6.6% led by 3%, or 11 million, increase in total subscribers1 and continued expansion of AMC Studios production capabilities

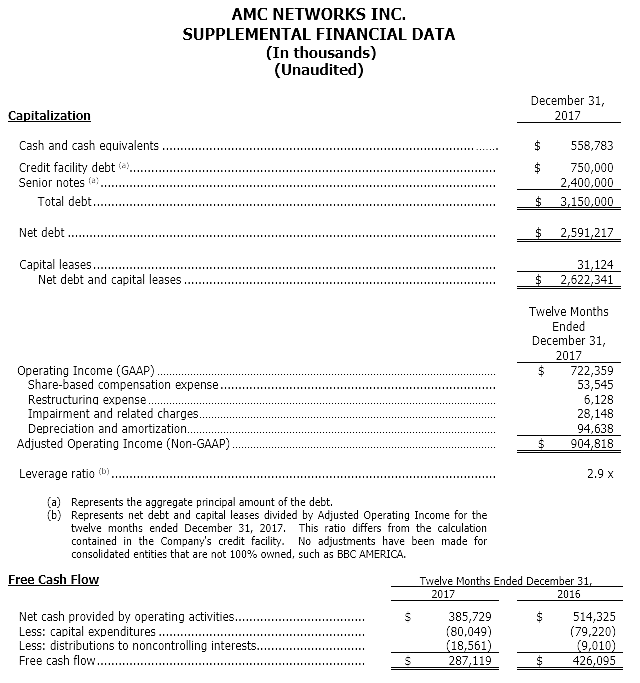

- Full year operating income increased 9.9% to a record $722 million; Full year Adjusted Operating Income2 increased 3.0% to a record $905 million

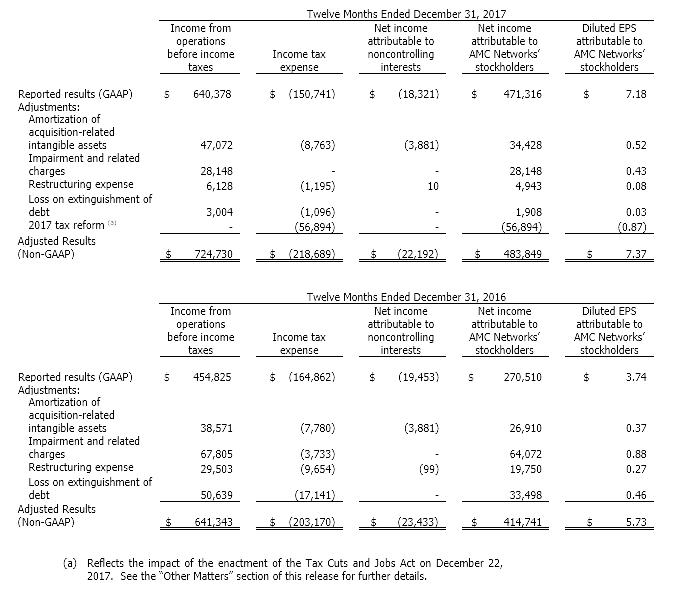

- Full year diluted EPS increased 92.0% to a record $7.18; Full year Adjusted EPS2 increased 28.7% to a record $7.37

- Company delivered another year of strong free cash flow generation — Cash provided by operating activities of $386 million; Free Cash Flow2 of $287 million

- Over the past 3 years, the Company has generated $1.3 billion in cumulative cash provided by operating activities and $1.0 billion in cumulative Free Cash Flow; Free Cash Flow profile expected to significantly benefit from recently announced changes in tax law

New York, NY – March 1, 2018: AMC Networks Inc. (“AMC Networks” or the “Company”) (NASDAQ: AMCX) today reported financial results for the full year and fourth quarter ended December 31, 2017.

President and Chief Executive Officer Josh Sapan said: “AMC Networks delivered record financial results in 2017, increasing net revenues and adjusted operating income for the seventh consecutive year since becoming a public company, and generating significant free cash flow that we are using to invest in key strategic initiatives and our networks.”

Mr. Sapan continued: “Our recent distribution deals with the streaming services fuboTV and Philo make AMC Networks available on more virtual MVPDS than any other independent programmer, proving the value of our discrete brands and our desirable, high-quality content. Our core networks continue to perform well, with AMC delivering 4 of the top 10 dramas on cable in 2017, with The Walking Dead, Fear the Walking Dead, Better Call Saul and Into the Badlands. ‘AMC Premiere’ continues to gain traction, with YouTube TV recently joining Comcast Xfinity in making our ad-free AMC streaming option available to its subscribers. Our owned streaming services Sundance Now and Shudder are seeing healthy subscriber growth and their momentum, coupled with the growth of the other streaming services we have invested in, including Acorn TV, Urban Movie Channel, and the BBC and ITV’s Britbox, highlights consumer demand for subscription streaming services with specialized content. As we continue to evolve and adapt in a world of changing viewer consumption habits, we believe AMC Networks occupies a position of unique strength and are confident that our size, our focus, and our portfolio of assets will enable us to continue to deliver strong financial results to our shareholders.”

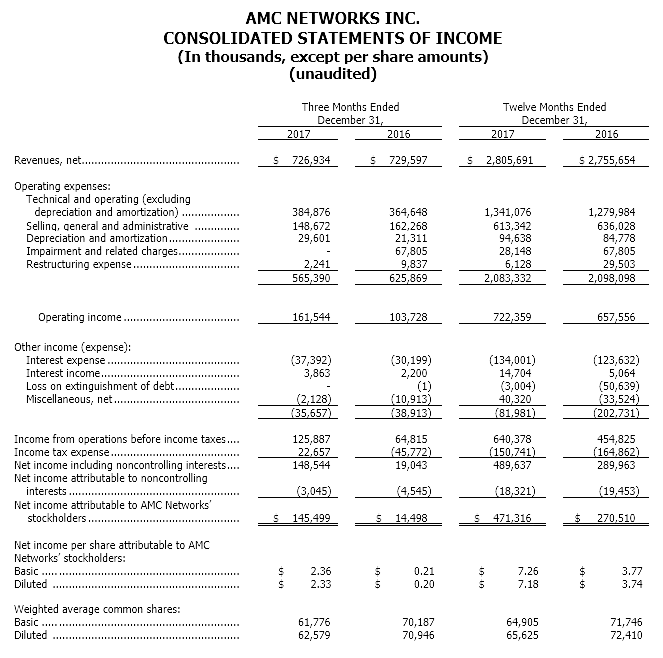

Fourth Quarter Results

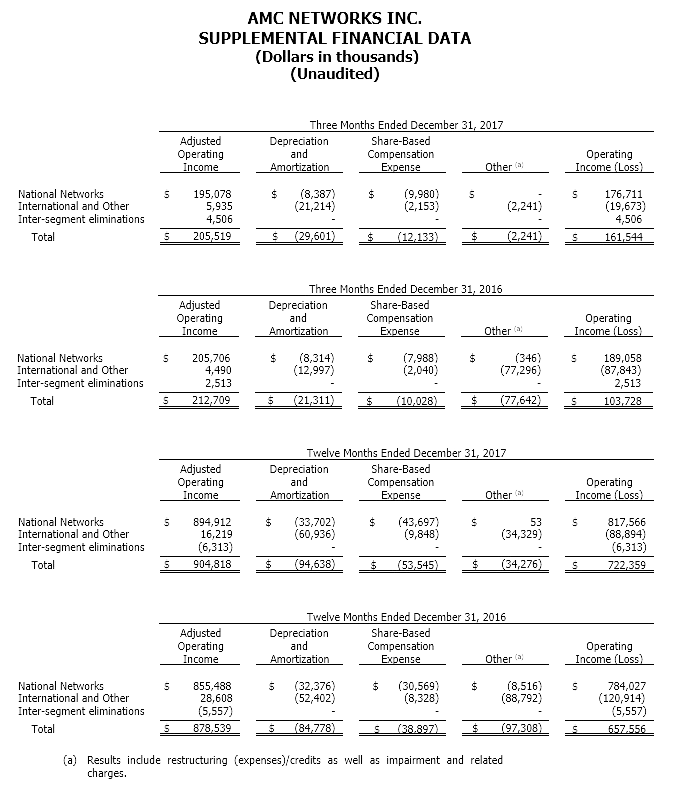

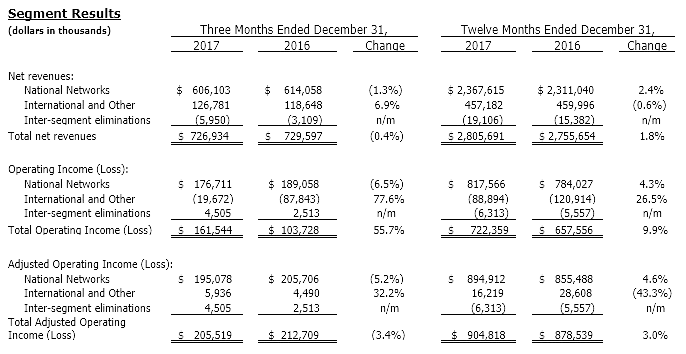

Fourth quarter net revenues decreased 0.4%, or $3 million, to $727 million over the fourth quarter of 2016. The decrease in net revenues reflected a decrease of 1.3% at National Networks and an increase of 6.9% at International and Other. Operating income was $162 million, an increase of 55.7%, or $58 million, versus the prior year period. The operating income increase reflected a decrease of 6.5% at National Networks offset by a decrease of 77.6% in operating loss at International and Other. The improvement in operating income was primarily related to the absence of $68 million in charges incurred in fourth quarter 2016 in connection to AMC Networks International – Digital Media Center, which was subsequently sold in July 2017. Adjusted Operating Income3 totaled $206 million, a decrease of 3.4%, or $7 million, versus the prior year period. National Networks adjusted operating income decreased 5.2% and International and Other adjusted operating income increased 32.2% versus the prior year period.

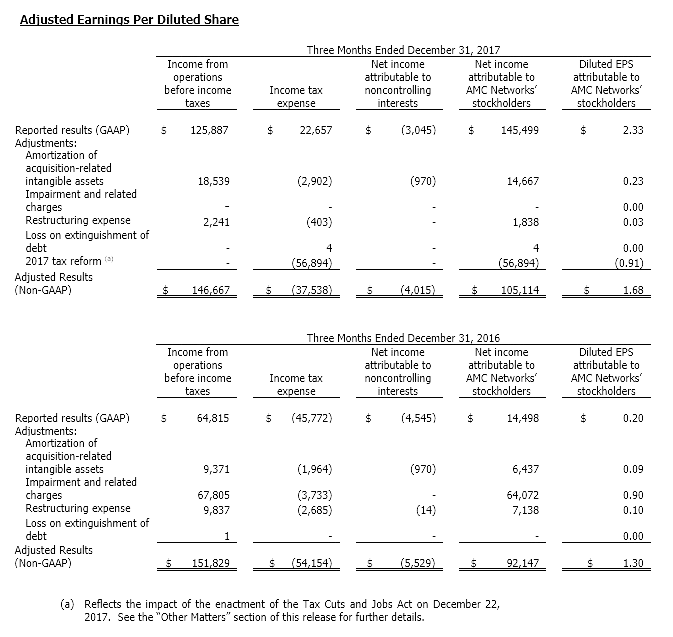

Fourth quarter net income was $146 million ($2.33 per diluted share), compared with $14 million ($0.20 per diluted share) in the fourth quarter of 2016. Fourth quarter Adjusted EPS3 was $105 million ($1.68 per diluted share), compared with $92 million ($1.30 per diluted share) in the fourth quarter of 2016. The increase in adjusted EPS was primarily related to a decrease in diluted shares, a decrease in income tax expense and a decrease in miscellaneous, net.

Full Year Results

Full year 2017 net revenues increased 1.8%, or $50 million, to $2.806 billion over full year 2016, reflecting 2.4% growth at National Networks and a decrease of 0.6% at International and Other. Operating income was $722 million, an increase of 9.9%, or $65 million, versus the prior year period. National Networks operating income increased 4.3% and International and Other operating loss decreased 26.5% versus the prior year period. Adjusted Operating Income totaled $905 million, an increase of 3.0%, or $26 million, versus the prior year period. National Networks adjusted operating income increased 4.6% and International and Other adjusted operating income decreased 43.3% versus the prior year period.

Full year net income was $471 million ($7.18 per diluted share), compared with $271 million ($3.74 per diluted share) in the prior year period. Full year adjusted EPS was $484 million ($7.37 per diluted share), compared with $415 million ($5.73 per diluted share) in the prior year period. The increase in adjusted EPS was primarily related to an increase in adjusted operating income, a decrease in miscellaneous, net and a decrease in diluted shares.

For the full year 2017, net cash provided by operating activities was $386 million, a decrease of $129 million versus the prior year period. The decrease was primarily the result of an increase in tax payments and working capital. Free Cash Flow3 for the full year 2017 was $287 million, a decrease of $139 million versus the prior year period. The decrease primarily reflects the decrease in net cash provided by operating activities as well as an increase in distributions to noncontrolling interests.

National Networks

National Networks principally consists of the Company’s five nationally distributed programming networks, AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business.

Fourth Quarter Results

National Networks revenues for the fourth quarter 2017 decreased 1.3% to $606 million, operating income decreased 6.5% to $177 million, and adjusted operating income decreased 5.2% to $195 million, all compared to the prior year period.

Fourth quarter revenues reflected a 6.8% increase in distribution revenues to $337 million. The increase in distribution revenues was primarily attributable to an increase in subscription revenue as well as content licensing revenues4. Advertising revenues decreased 9.9% to $269 million. The decrease in advertising revenues principally related to lower delivery partially offset by higher pricing.

The decrease in fourth quarter operating income and adjusted operating income reflected the decrease in revenues as well as an increase in operating expenses. The increase in operating expenses was primarily attributable to higher programming expenses. Programming expenses included charges of $38 million in the current year period related to the write-off of programming assets, as compared to charges of $5 million in the prior year period. Operating income also reflected an increase in share-based compensation expense.

Full Year Results

National Networks revenues for the full year 2017 increased 2.4% to $2.368 billion, operating income increased 4.3% to $818 million, and adjusted operating income increased 4.6% to $895 million, all compared to the prior year period.

Full year revenues reflected a 6.6% increase in distribution revenues to $1.408 billion. The increase in distribution revenues was primarily attributable to an increase in subscription revenue as well as content licensing revenues. Advertising revenues decreased 3.1% to $960 million. The decrease in advertising revenues principally related to lower delivery partially offset by higher pricing.

The increase in full year operating income and adjusted operating income reflected the increase in revenues partially offset by an increase in operating expenses. The increase in operating expenses was primarily attributable to higher programming expenses. Programming expenses included charges of $48 million in the current year period related to the write-off of programming assets, as compared to charges of $26 million in the prior year period. Operating income also reflected an increase in share-based compensation expense.

International and Other

International and Other principally consists of AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; and the Company’s owned subscription streaming services, Sundance Now and Shudder.

Fourth Quarter Results

International and Other revenues for the fourth quarter of 2017 increased $8 million to $127 million, operating loss decreased $68 million to a loss of $20 million, and adjusted operating income increased $1 million to $6 million, all compared to the prior year period.

Fourth quarter revenues primarily reflect an increase in revenues at the Company’s international programming networks partially offset by the absence of AMCNI-DMC, the Company’s Amsterdam-based media logistics facility.

Fourth quarter operating loss and adjusted operating income reflected the increase in revenues as well as an increase in operating expenses. The increase in operating expenses were primarily attributable to higher expenses at the Company’s international networks partially offset by the absence of costs related to AMCNI-DMC. The improvement in operating loss also reflects the absence of impairment and related charges of $68 million recorded in the prior year period in connection with AMCNI-DMC.

Full Year Results

International and Other revenues for the full year 2017 decreased $3 million to $457 million, operating loss decreased $32 million to a loss of $89 million, and adjusted operating income decreased $12 million to $16 million, all compared to the prior year period.

Full year revenues primarily reflect the absence of AMCNI-DMC, the Company’s Amsterdam-based media logistics facility partially offset by an increase in revenues at the Company’s international programming networks.

Full year operating loss and adjusted operating income reflected the decrease in revenues as well as an increase in operating expenses. The increase in operating expenses were primarily attributable to higher expenses at the Company’s international networks and subscription streaming services partially offset by the absence of costs related to AMCNI-DMC. The improvement in operating loss also reflects a decrease in impairment and related charges in connection with AMCNI-DMC.

Other Matters

Stock Repurchase Program

As previously disclosed, in March 2016, the Company announced that its Board of Directors authorized a program to repurchase up to $500 million of its outstanding shares of common stock. In June 2017, the Company announced that its Board of Directors authorized an increase of $500 million to its previously announced program. The Company will determine the timing and the amount of any repurchases based on its evaluation of market conditions, share price, and other factors. The stock repurchase program has no pre-established closing date and may be suspended or discontinued at any time. During the fourth quarter, the Company repurchased approximately 1.6 million shares for $88 million. For the full year, the Company repurchased approximately 7.8 million shares for $434 million. From January 1, 2018 through February 23, 2018, the Company repurchased approximately 389,000 additional shares for $20 million. As of February 23, 2018, the Company had $322 million available under its stock repurchase authorization.

Tax Cuts and Jobs Act

On December 22, 2017, the Tax Cuts and Jobs Act was enacted. As a result, in the fourth quarter the Company recorded a tax benefit of $67.9 million which represented the one-time impact of the change in the corporate tax rate on deferred tax assets and liabilities. The Company also recorded a one-time increase in income tax expense of $11.0 million associated with the deemed repatriation of foreign earnings.

Proposal to Acquire RLJ Entertainment, Inc.

As previously disclosed, on February 26, 2018, the Company announced a proposal to acquire the outstanding shares of RLJ Entertainment, Inc. (“RLJE”) not currently owned by AMC Networks or entities affiliated with Robert L. Johnson for a purchase price of $4.25 per share in cash. Through this offer, the Company intends for RLJE to become a privately owned subsidiary of AMC Networks, with a minority stake held by Mr. Johnson. The board of directors of RLJE has formed a special committee of independent directors to consider the proposal. There can be no assurance that the proposal made by the Company to RLJE will result in a transaction or the terms upon which any transaction may occur.

fuboTV Distribution Agreement

On February 28, 2018, the Company entered into a multi-year distribution agreement with fuboTV, a leading streaming subscription service for live sports and entertainment.

Please see the Company’s Form 10-K for the period ended December 31, 2017 for further details regarding the above matters.

Description of Non-GAAP Measures

The Company defines Adjusted Operating Income, which is a non-GAAP financial measure, as operating income (loss) before depreciation and amortization, share-based compensation expense or benefit, impairment and related charges (including gains or losses on sales or dispositions of businesses), and restructuring expense or credit. Because it is based upon operating income (loss), Adjusted Operating Income also excludes interest expense (including cash interest expense) and other non-operating income and expense items. The Company believes that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of the various operating units of the business without regard to the effect of the settlement of an obligation that is not expected to be made in cash.

The Company believes that Adjusted Operating Income is an appropriate measure for evaluating the operating performance of the business segments and the Company on a consolidated basis. Adjusted Operating Income and similar measures with similar titles are common performance measures used by investors, analysts and peers to compare performance in the industry.

Internally, the Company uses net revenues and Adjusted Operating Income measures as the most important indicators of its business performance, and evaluates management’s effectiveness with specific reference to these indicators. Adjusted Operating Income should be viewed as a supplement to and not a substitute for operating income (loss), net income (loss), and other measures of performance presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Since Adjusted Operating Income is not a measure of performance calculated in accordance with GAAP, this measure may not be comparable to similar measures with similar titles used by other companies. For a reconciliation of Adjusted Operating Income to operating income (loss), please see page 9 of this release.

The Company defines Free Cash Flow (“Free Cash Flow”), which is a non-GAAP financial measure, as net cash provided by operating activities less capital expenditures and cash distributions to noncontrolling interests, all of which are reported in our Consolidated Statement of Cash Flows. The Company believes the most comparable GAAP financial measure of its liquidity is net cash provided by operating activities. The Company believes that Free Cash Flow is useful as an indicator of its overall liquidity, as the amount of Free Cash Flow generated in any period is representative of cash that is available for debt repayment, investment, and other discretionary and non-discretionary cash uses. The Company also believes that Free Cash Flow is one of several benchmarks used by analysts and investors who follow the industry for comparison of its liquidity with other companies in the industry, although the Company’s measure of Free Cash Flow may not be directly comparable to similar measures reported by other companies. For a reconciliation of Free Cash Flow to net cash provided by operating activities, please see page 10 of this release.

The Company defines Adjusted Earnings per Diluted Share (“Adjusted EPS”), which is a non-GAAP financial measure, as earnings per diluted share excluding the following items: amortization of acquisition-related intangible assets; impairment and related charges (including gains or losses on sales or dispositions of businesses); non-cash impairments of goodwill, intangible and fixed assets and investments; restructuring expense; and gains and losses related to the extinguishment of debt; as well as the impact of taxes on the aforementioned items. The Company believes the most comparable GAAP financial measure is earnings per diluted share. The Company believes that Adjusted EPS is one of several benchmarks used by analysts and investors who follow the industry for comparison of its performance with other companies in the industry, although the Company’s measure of Adjusted EPS may not be directly comparable to similar measures reported by other companies. For a reconciliation of Adjusted EPS to earnings per diluted share, please see pages 11-12 of this release.

Forward-Looking Statements

This earnings release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results or developments may differ materially from those in the forward-looking statements as a result of various factors, including financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industries in which it operates and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

Conference Call Information

AMC Networks will host a conference call today at 10:00 a.m. ET to discuss its full year and fourth quarter 2017 results. To listen to the call, visit http://www.amcnetworks.com or dial 1-877-347-9170, using the following passcode: 8987629.

About AMC Networks Inc.

AMC Networks owns and operates several of cable television’s most recognized brands delivering high quality content to audiences and a valuable platform to distributors and advertisers. The Company manages its business through two operating segments: (i) National Networks, which principally includes AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business; and (ii) International and Other, which principally includes AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; and the Company’s owned subscription streaming services, Sundance Now and Shudder. For more information on AMC Networks, please visit the Company’s website at http://www.amcnetworks.com.

- Estimated U.S. subscribers as measured by Nielsen on December 31, 2017 and 2016, respectively.

- See page 5 of this earnings release for a discussion of non-GAAP financial measures used in this release. This discussion includes the definition of Adjusted Operating Income (Loss), Adjusted EPS and Free Cash Flow.

- See page 5 of this earnings release for a discussion of non-GAAP financial measures used in this release. This discussion includes the definition of Adjusted Operating Income (Loss), Adjusted EPS and Free Cash Flow.

- The Company has renamed the components of Distribution Revenue. The Company formerly referred to Subscription Revenues as Affiliate Revenues. The Company also formerly referred to Content Licensing Revenues as Non-Affiliate Revenues or Digital Distribution and Licensing Revenues. The Company believes that the change more appropriately describes our revenue streams. The change has no impact on total Distribution Revenues as previously disclosed. See the Company’s Form 10-K for the period ended December 31, 2017 for further details.