Company continues to increase total subscribers, up 2% year-over-year

New York, NY – May 10, 2018: AMC Networks Inc. (“AMC Networks” or the “Company”) (NASDAQ: AMCX) today reported financial results for the first quarter ended March 31, 2018.

“AMC Networks delivered strong performance in the first quarter of 2018 with record total company revenues and earnings per share. We have grown total distribution of our networks, reflecting the strength of our well-priced, well-defined brands; the quality of our programming and its popularity with viewers; and the value we create for both traditional and emerging distribution platforms. AMC Networks has the lowest priced offering of any independent programmer and is the most widely available independent programmer among virtual MVPDs, an indicator of our strong position as these emerging platforms continue to grow,” said Josh Sapan, President and CEO of AMC Networks. “Our content continues to break through in a cluttered environment, with recent series including BBC AMERICA’s Killing Eve, IFC’s Brockmire, and AMC’s Fear the Walking Dead and The Terror drawing wide critical acclaim and strong viewership, and our streaming services, Sundance Now and Shudder, continue to gain traction with consumers. As we focus on delivering shareholder value in the near and long-term, we remain disciplined in our approach to content investments and managing costs while increasingly diversifying our revenue mix through content sales, franchise monetization and new distribution platforms.”

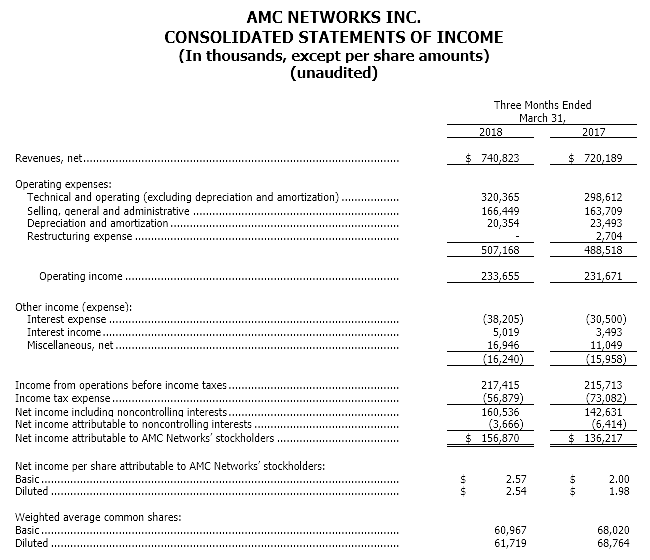

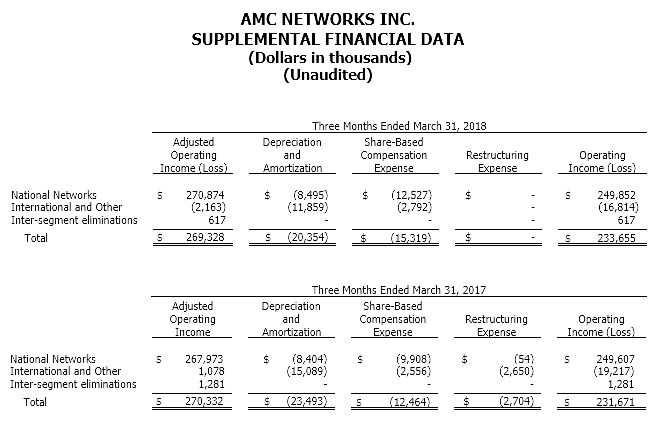

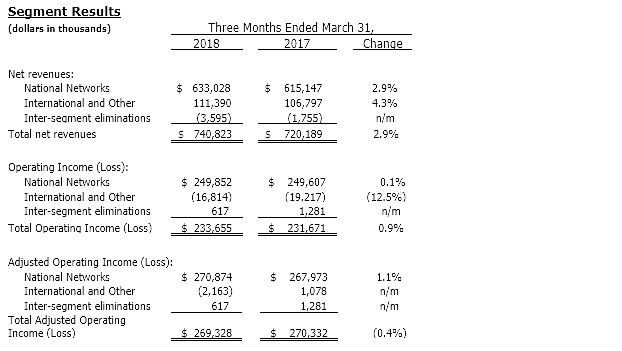

First quarter net revenues increased 2.9%, or $21 million, to $741 million over the first quarter of 2017. The increase in net revenues reflected 2.9% growth at National Networks and 4.3% growth at International and Other. Operating income was $234 million, an increase of 0.9%, or $2 million, versus the prior year period. The increase reflected essentially flat operating income at National Networks and a decrease of $2 million in operating loss at International and Other. Adjusted Operating Income2 was $269 million, essentially flat with the prior year period. Results reflected a 1.1% increase at National Networks offset by a decrease of $3 million at International and Other.

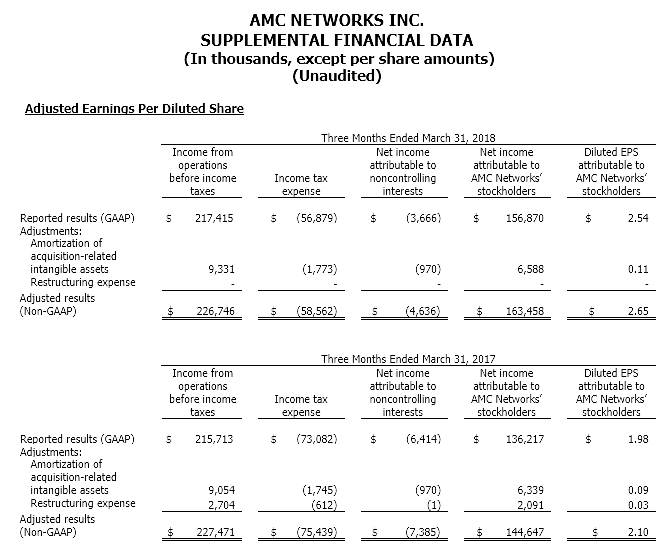

First quarter net income was $157 million ($2.54 per diluted share), compared with $136 million ($1.98 per diluted share) in the first quarter of 2017. First quarter Adjusted EPS2 was $163 million ($2.65 per diluted share), compared with $145 million ($2.10 per diluted share) in the first quarter of 2017. The increase in adjusted EPS was primarily related to a decrease in income tax expense and a decrease in diluted shares.

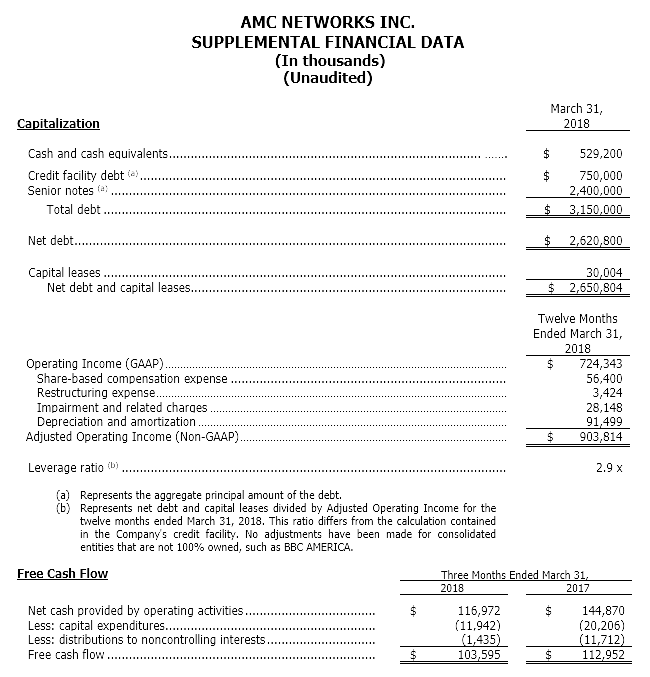

For the three months ended March 31, 2018, net cash provided by operating activities was $117 million, a decrease of $28 million versus the prior year period. The decrease was primarily the result of an increase in interest payments and working capital. Free Cash Flow2 for the three months ended March 31, 2018 was $104 million, a decrease of $9 million versus the prior year period. The decrease primarily reflects the decrease in net cash provided by operating activities partially offset by a decrease in capital expenditures and distributions to noncontrolling interests.

National Networks

National Networks principally consists of the Company’s five nationally distributed programming networks, AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business.

National Networks revenues for the first quarter 2018 increased 2.9% to $633 million, operating income increased 0.1% to $250 million, and adjusted operating income increased 1.1% to $271 million, all compared to the prior year period.

First quarter growth in revenues was led by a 10.8% increase in distribution revenues to $407 million.

The increase in distribution revenues was primarily attributable to an increase in content licensing revenues as well as an increase in subscription revenues. Advertising revenues decreased 8.8% to $226 million. The decrease in advertising revenues principally related to lower delivery as well as the timing of the airing of original programming partially offset by higher pricing.

First quarter operating income and adjusted operating income reflected the increase in revenues offset by an increase in operating expenses. The increase in operating expenses was primarily attributable to higher programming expenses.

International and Other

International and Other principally consists of AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; and the Company’s owned subscription streaming services, Sundance Now and Shudder.

International and Other revenues for the first quarter of 2018 increased 4.3% to $111 million, operating loss decreased $2 million to a loss of $17 million, and adjusted operating income decreased $3 million to a loss of $2 million, all compared to the prior year period.

First quarter growth in revenues primarily reflected the favorable impact of foreign currency translation at the Company’s international programming networks as well as an increase from our subscription streaming services partially offset by the absence of AMCNI-DMC, the Company’s Amsterdam-based media logistics facility which was sold in July 2017.

First quarter operating loss reflected the increase in revenues as well as a decrease in depreciation and amortization and restructuring expense partially offset by an increase in operating expenses. Adjusted operating income reflected the increase in revenue offset by the increase in operating expenses.

Other Matters

Stock Repurchase Program

As previously disclosed, on March 7, 2016, the Company announced that its Board of Directors authorized a program to repurchase up to $500 million of its outstanding shares of common stock. In June 2017, the Company announced that its Board of Directors authorized an increase of $500 million to its previously announced program. The Company determines the timing and the amount of any repurchases based on its evaluation of market conditions, share price, and other factors. The stock repurchase program has no pre-established closing date and may be suspended or discontinued at any time. During the first quarter, the Company repurchased approximately 1.6 million shares for $84 million. From April 1, 2018 through May 4, 2018, the Company repurchased approximately 2.4 million additional shares for $125 million. As of May 4, 2018, the Company had $134 million available under its stock repurchase authorization.

Proposal to Acquire RLJ Entertainment, Inc.

As previously disclosed, on February 26, 2018, the Company announced a proposal to acquire the outstanding shares of RLJ Entertainment, Inc. (“RLJE”) not currently owned by AMC Networks or entities affiliated with Robert L. Johnson for a purchase price of $4.25 per share in cash. Through this offer, the Company intends for RLJE to become a privately owned subsidiary of AMC Networks, with a minority stake held by Mr. Johnson. The board of directors of RLJE has formed a special committee of independent directors to consider the proposal. There can be no assurance that the proposal made by the Company to RLJE will result in a transaction or the terms upon which any transaction may occur.

Levity Live Agreement

As previously disclosed, on April 27, Company announced that it acquired a majority ownership stake in Levity Live, a vertically integrated media company that owns and operates comedy venues, operates a talent management business and produces original content for distribution on multiple platforms, including live, digital and linear television.

Please see the Company’s Form 10-Q for the period ended March 31, 2018 for further details regarding the above matters.

Description of Non-GAAP Measures

The Company defines Adjusted Operating Income (Loss), which is a non-GAAP financial measure, as operating income (loss) before depreciation and amortization, share-based compensation expense or benefit, impairment and related charges (including gains or losses on sales or dispositions of businesses), and restructuring expense or credit. Because it is based upon operating income (loss), Adjusted Operating Income (Loss) also excludes interest expense (including cash interest expense) and other non-operating income and expense items. The Company believes that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of the various operating units of the business without regard to the effect of the settlement of an obligation that is not expected to be made in cash.

The Company believes that Adjusted Operating Income (Loss) is an appropriate measure for evaluating the operating performance of the business segments and the Company on a consolidated basis. Adjusted Operating Income (Loss) and similar measures with similar titles are common performance measures used by investors, analysts and peers to compare performance in the industry.

Internally, the Company uses net revenues and Adjusted Operating Income (Loss) measures as the most important indicators of its business performance, and evaluates management’s effectiveness with specific reference to these indicators. Adjusted Operating Income (Loss) should be viewed as a supplement to and not a substitute for operating income (loss), net income (loss), and other measures of performance presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Since Adjusted Operating Income (Loss) is not a measure of performance calculated in accordance with GAAP, this measure may not be comparable to similar measures with similar titles used by other companies. For a reconciliation of Adjusted Operating Income (Loss) to operating income (loss), please see page 7 of this release.

The Company defines Free Cash Flow (“Free Cash Flow”), which is a non-GAAP financial measure, as net cash provided by operating activities less capital expenditures and cash distributions to noncontrolling interests, all of which are reported in our Consolidated Statement of Cash Flows. The Company believes the most comparable GAAP financial measure of its liquidity is net cash provided by operating activities. The Company believes that Free Cash Flow is useful as an indicator of its overall liquidity, as the amount of Free Cash Flow generated in any period is representative of cash that is available for debt repayment, investment, and other discretionary and non-discretionary cash uses. The Company also believes that Free Cash Flow is one of several benchmarks used by analysts and investors who follow the industry for comparison of its liquidity with other companies in the industry, although the Company’s measure of Free Cash Flow may not be directly comparable to similar measures reported by other companies. For a reconciliation of Free Cash Flow to net cash provided by operating activities, please see page 8 of this release.

The Company defines Adjusted Earnings per Diluted Share (“Adjusted EPS”), which is a non-GAAP financial measure, as earnings per diluted share excluding the following items: amortization of acquisition-related intangible assets; non-cash impairments of goodwill, intangible and fixed assets and investments; restructuring expense; and gains and losses related to the extinguishment of debt; as well as the impact of taxes on the aforementioned items. The Company believes the most comparable GAAP financial measure is earnings per diluted share. The Company believes that Adjusted EPS is one of several benchmarks used by analysts and investors who follow the industry for comparison of its performance with other companies in the industry, although the Company’s measure of Adjusted EPS may not be directly comparable to similar measures reported by other companies. For a reconciliation of Adjusted EPS to earnings per diluted share, please see page 9 of this release.

Forward-Looking Statements

This earnings release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results or developments may differ materially from those in the forward-looking statements as a result of various factors, including financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industries in which it operates and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

Conference Call Information

AMC Networks will host a conference call today at 8:30 a.m. ET to discuss its first quarter 2018 results. To listen to the call, visit http://www.amcnetworks.com or dial 1-877-347-9170, using the following passcode: 5598435.

About AMC Networks Inc.

AMC Networks owns and operates several of cable television’s most recognized brands delivering high quality content to audiences and a valuable platform to distributors and advertisers. The Company manages its business through two operating segments: (i) National Networks, which principally includes AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business; and (ii) International and Other, which principally includes AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; and the Company’s owned subscription streaming services, Sundance Now and Shudder. For more information on AMC Networks, please visit the Company’s website at http://www.amcnetworks.com.

- Estimated U.S. subscribers as measured by Nielsen on March 31, 2018 and 2017, respectively.

- See page 3 of this earnings release for a discussion of non-GAAP financial measures used in this release. This discussion includes the definition of Adjusted Operating Income (Loss), Adjusted EPS and Free Cash Flow.