New York, NY – May 9, 2025: AMC Networks Inc. (“AMC Networks” or the “Company”) (NASDAQ: AMCX) today reported financial results for the first quarter ended March 31, 2025.

Chief Executive Officer Kristin Dolan said: “We continue to execute on our core strengths as we navigate the changing world of media. During the first quarter we delivered high-quality premium programming to our audiences, launched ad-supported AMC+ on Charter and generated $94 million of free cash flow.(1) We remain nimble and opportunistic in broadly distributing our sought-after content across all available platforms to build value for our partners, viewers and shareholders.”

Operational Highlights:

- Launched ad-supported AMC+ availability for Spectrum TV Select customers at the end of March as part of our early, multi-year renewal with Charter announced last September.

- Continued expansion of our growing FAST channels business with upcoming launch of new FAST channel, Acorn TV Mysteries.

- Dark Winds returned for its third season with approximately 2.2 million premiere night viewers and a significant increase in AMC+ direct-to-consumer acquisition activity over the previous season. The series, which continues to receive near universal critical acclaim, has been renewed for a fourth season.

- Continued strong momentum across the Anne Rice Immortal Universe, with the upcoming launch of new series: Anne Rice’s Talamasca: The Secret Order, debuting this fall and renewal of Anne Rice’s Mayfair Witches for a third season.

- Announced development of a new AMC Studios franchise, Great American Stories, built on iconic American stories. Each season will be devoted to a different celebrated work, historical moment, or individual narrative celebrating the American spirit, starting with The Grapes of Wrath.

- Greenlit Allie & Andi, a new Acorn TV crime drama, with Brooke Shields starring and executive producing.

- As the Company continues to dominate the horror space, it is offering advertisers unparalleled access to a loyal and engaged fan base through new opportunities including the upcoming ad-supported launch of Shudder; Shudder’s 10-year anniversary this year; and a multi-platform partnership with Sphere this fall across FearFest, Shudder and Sphere’s annual “Sphere of Fear” Exosphere show.

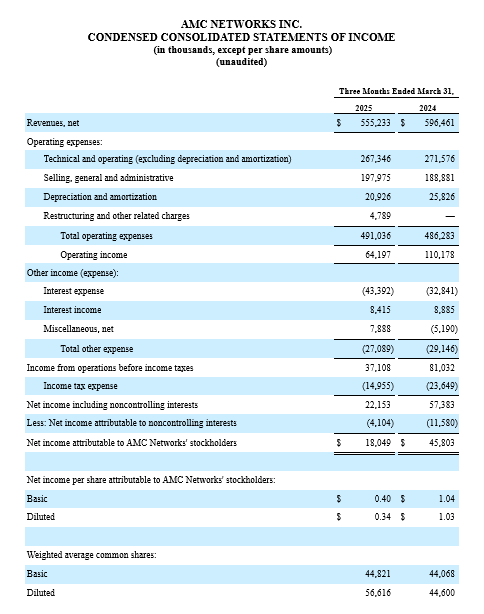

Financial Highlights – First Quarter Ended March 31, 2025:

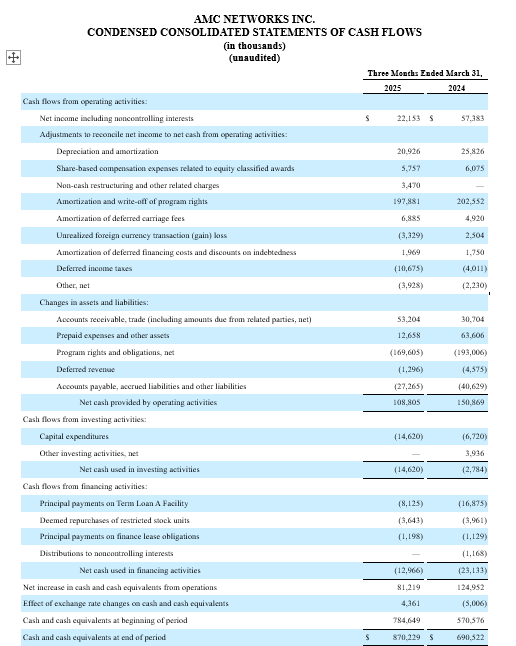

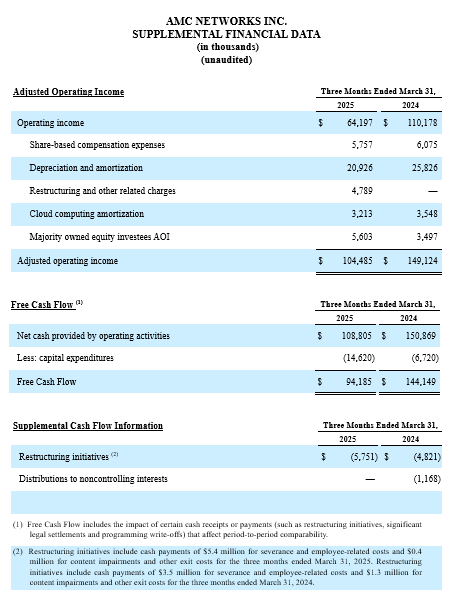

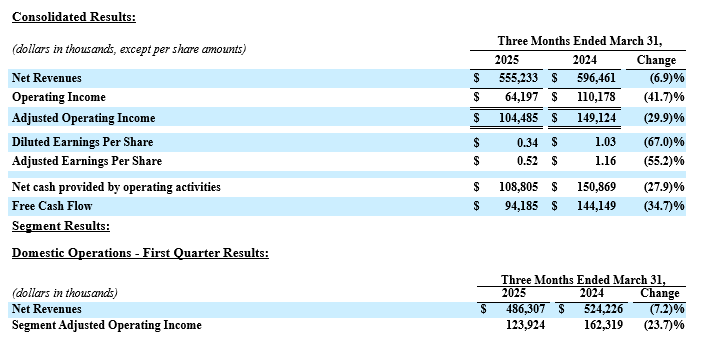

- Net cash provided by operating activities of $109 million; Free Cash Flow(1) of $94 million.

- Operating income of $64 million; Adjusted Operating Income(1) of $104 million, with a margin of 19%.

- Net revenues of $555 million decreased 7% from the prior year.

- Streaming revenues of $157 million increased 8% from the prior year.

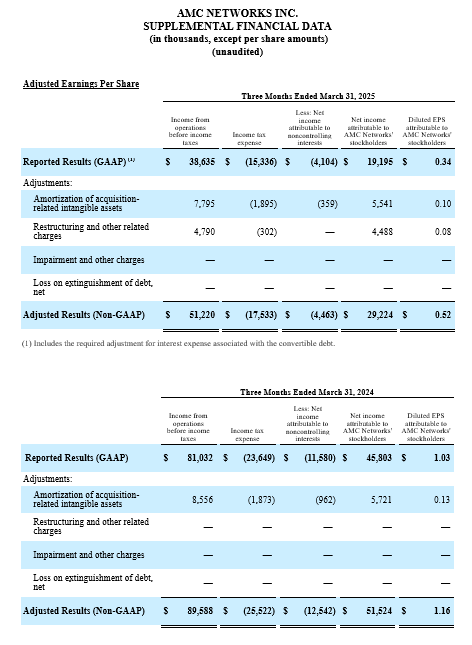

- Diluted EPS of $0.34; Adjusted EPS(1) of $0.52.

- Domestic Operations revenues decreased 7% from the prior year to $486 million.

- Subscription revenues decreased 3% to $313 million due to declines in the linear subscriber universe, partially offset by streaming revenue growth.

- Streaming revenues increased 8% to $157 million primarily due to the impact of price increases across our services.

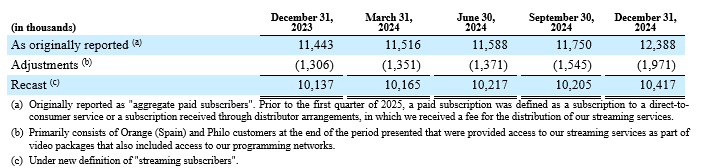

- In the first quarter, we updated our streaming subscriber definition to only include subscribers who register on an a la carte basis and from whom we receive a fee for one of our streaming services, directly through our direct-to-consumer (“DTC”) applications or indirectly through one of our streaming platform arrangements. This definitional change resulted in the exclusion of subscribers from our count who received access to our streaming services from distributors through a video package that also included access to our programming networks. Subscribers in this release reflect our updated definition. Recast subscribers for historical periods can be found in the “Other Matters” section of this release. Streaming subscribers of 10.2 million as of March 31, 2025 were consistent with streaming subscribers as of March 31, 2024. Streaming subscribers declined slightly as compared to 10.4 million subscribers at the end of 2024. The sequential decrease reflects our continued focus on higher quality subscribers, which was realized through the implementation of tighter credit standards for new sign-ups across our DTC and partner acquisition funnels as well as the timing and cadence of our content slate and subscriber acquisition marketing. We are already seeing the benefits of the further strengthening of our subscriber base with strong retention and engagement across the portfolio. In the first quarter we saw a year-over-year improvement in retention, and in terms of engagement we saw a sequential double-digit increase in viewership hours per subscriber.

- Affiliate revenues declined 12% to $156 million primarily due to basic subscriber declines, and to a lesser extent, contractual rate decreases in connection with renewals.

- Streaming revenues increased 8% to $157 million primarily due to the impact of price increases across our services.

- Content licensing revenues decreased 13% to $54 million due to the availability of deliveries in the period, including the prior year beneficial impact of the sale of our rights and interests to Killing Eve in the first quarter of 2024.

- Advertising revenues decreased 15% to $119 million primarily due to linear ratings declines.

- Subscription revenues decreased 3% to $313 million due to declines in the linear subscriber universe, partially offset by streaming revenue growth.

- Adjusted Operating Income decreased 24% to $124 million, with a margin of 25%. The decrease in Adjusted Operating Income was primarily driven by continued revenue headwinds in our linear businesses.

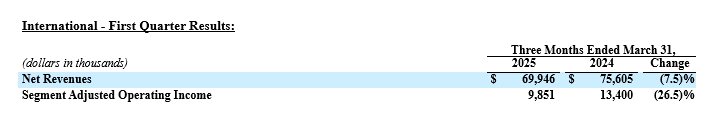

- International revenues decreased 7% from the prior year to $70 million.

- Subscription revenues decreased 12% to $45 million primarily due to the non-renewal of a distribution agreement in Spain in the fourth quarter of 2024.

- Advertising revenues increased 5% to $23 million due to increased ratings and advertising growth in the U.K., including digital and advanced advertising, partially offset by lower advertising revenues across our other European markets.

- Adjusted Operating Income decreased 26% to $10 million. The decrease in Adjusted Operating Income was primarily driven by the impact of the non-renewal of a distribution agreement in Spain in the fourth quarter of 2024.

Other Matters

Open Market Repurchases of 4.25% Senior Notes due 2029

In April 2025, the Company repurchased $32 million principal amount of its 4.25% senior notes due February 2029 through open market repurchases, at a $9 million discount, and retired the repurchased notes.

Streaming Subscribers and Subscription Revenue Reporting Changes

In the first quarter of 2025, the Company updated its definition of “streaming subscribers” and the definitions of “affiliate revenues” and “streaming revenues”. These changes have no effect on the Company’s consolidated financial statements or results of operations. The impact of these changes to historical affiliate revenues and streaming revenues is not material. The new definitions are as follows:

Streaming subscriber (previously “aggregate paid subscriber”): A subscriber who registers on an a la carte basis and from whom we receive a fee for one of our streaming services directly through our DTC applications or indirectly through one of our streaming platform arrangements.

The Company expects to provide further updates over time regarding the trending of customers that are provided access to our streaming services as part of video packages that also include access to our programming networks to ensure a holistic picture of the Company’s programming distribution.

The following table sets forth our streaming subscribers, presented under both the old definition of “aggregate paid subscriber” and the new definition of “streaming subscriber” as of each date indicated.

Affiliate revenues: Represents fees received from distributors for the rights to use the Company’s programming under multi-year contracts, commonly referred to as “affiliation agreements.” Affiliate revenues also include fees received from distributors who provide access to our streaming services to customers through a video package that also includes access to our programming networks. Affiliate revenues are earned from cable and other multichannel video programming distribution platforms, including direct broadcast satellite and platforms operated by telecommunications providers and virtual multichannel video programming distributors.

Streaming revenues: Represents fees for our streaming services earned from our DTC platforms as well as through streaming platform arrangements with companies that sell our streaming services on our behalf.

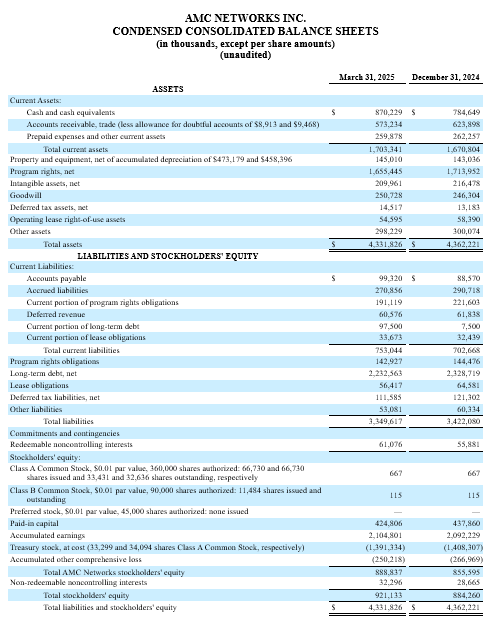

Stock Repurchase Program & Outstanding Shares

As previously disclosed, the Company’s Board of Directors has authorized a program to repurchase up to $1.5 billion of the Company’s outstanding shares of Class A Common Stock. The Stock Repurchase Program has no pre-established termination date and may be suspended or discontinued at any time. During the three months ended March 31, 2025, the Company did not repurchase any shares. As of March 31, 2025, the Company had $135 million of authorization remaining for repurchase under the Stock Repurchase Program.

As of May 2, 2025, the Company had 33,442,870 shares of Class A Common Stock and 11,484,408 shares of Class B Common Stock outstanding.

Please see the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2025, which will be filed later today, for further details regarding the above matters.

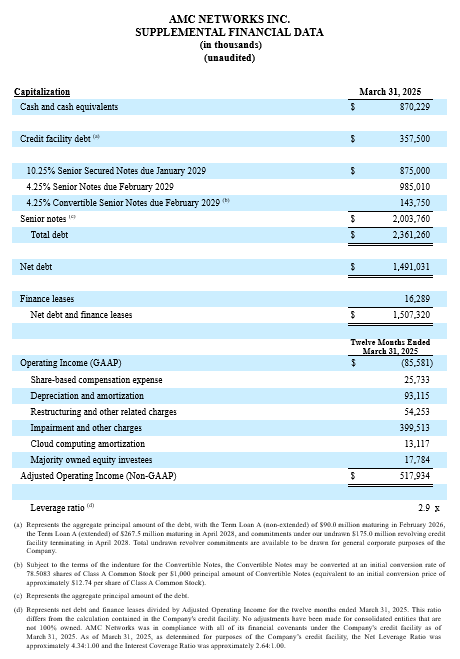

Description of Non-GAAP Measures

Internally, the Company uses Adjusted Operating Income (Loss) and Free Cash Flow measures as the most important indicators of its business performance and evaluates management’s effectiveness with specific reference to these indicators.

The Company defines Adjusted Operating Income (Loss), which is a non-GAAP financial measure, as operating income (loss) before share-based compensation expense or benefit, depreciation and amortization, impairment and other charges (including gains or losses on sales or dispositions of businesses), restructuring and other related charges, cloud computing amortization, and including the Company’s proportionate share of adjusted operating income (loss) from majority-owned equity method investees. From time to time, we may exclude the impact of certain events, gains, losses, or other charges (such as significant legal settlements) from AOI that affect our operating performance. Because it is based upon operating income (loss), Adjusted Operating Income (Loss) also excludes interest expense (including cash interest expense) and other non-operating income and expense items. The Company believes that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of the various operating units of the business without regard to the effect of the settlement of an obligation that is not expected to be made in cash.

The Company believes that Adjusted Operating Income (Loss) is an appropriate measure for evaluating the operating performance of the business segments and the Company on a consolidated basis. Adjusted Operating Income (Loss) and similar measures with similar titles are common performance measures used by investors, analysts, and peers to compare performance in the industry.

Adjusted Operating Income (Loss) should be viewed as a supplement to and not a substitute for operating income (loss), net income (loss), and other measures of performance presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Since Adjusted Operating Income (Loss) is not a measure of performance calculated in accordance with GAAP, this measure may not be comparable to similar measures with similar titles used by other companies. For a reconciliation of operating income (loss) to Adjusted Operating Income (Loss), please see page 10 of this release.

The Company defines Free Cash Flow, which is a non-GAAP financial measure, as net cash provided by operating activities less capital expenditures, all of which are reported in our Consolidated Statement of Cash Flows. The Company believes the most comparable GAAP financial measure of its liquidity is net cash provided by operating activities. The Company believes that Free Cash Flow is useful as an indicator of its overall liquidity, as the amount of Free Cash Flow generated in any period is representative of cash that is available for debt repayment, investment, and other discretionary and non-discretionary cash uses. The Company also believes that Free Cash Flow is one of several benchmarks used by analysts and investors who follow the industry for comparison of its liquidity with other companies in the industry, although the Company’s measure of Free Cash Flow may not be directly comparable to similar measures reported by other companies. For a reconciliation of net cash provided by operating activities to Free Cash Flow, please see page 10 of this release.

The Company defines Adjusted Earnings per Diluted Share (“Adjusted EPS”), which is a non-GAAP financial measure, as earnings per diluted share excluding the following items: amortization of acquisition-related intangible assets; impairment and other charges (including gains or losses on sales or dispositions of businesses); non-cash impairments of goodwill, intangible and fixed assets; restructuring and other related charges; and the impact associated with the modification of debt arrangements, including gains and losses related to the extinguishment of debt; as well as the impact of taxes on the aforementioned items. The Company believes the most comparable GAAP financial measure is earnings per diluted share. The Company believes that Adjusted EPS is one of several benchmarks used by analysts and investors who follow the industry for comparison of its performance with other companies in the industry, although the Company’s measure of Adjusted EPS may not be directly comparable to similar measures reported by other companies. For a reconciliation of earnings per diluted share to Adjusted EPS, please see page 11 of this release.

Forward-Looking Statements

This earnings release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties and that actual results or developments may differ materially from those in the forward-looking statements as a result of various factors, including financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industries in which it operates and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

Conference Call Information

AMC Networks will host a conference call today at 8:30 a.m. ET to discuss its first quarter 2025 results. To listen to the call, please visit investors.amcnetworks.com.

About AMC Networks Inc.

AMC Networks (Nasdaq: AMCX) is home to many of the greatest stories and characters in TV and film and the premier destination for passionate and engaged fan communities around the world. The Company creates and curates celebrated series and films across distinct brands and makes them available to audiences everywhere. Its portfolio includes targeted streaming services AMC+, Acorn TV, Shudder, Sundance Now, ALLBLK and HIDIVE; cable networks AMC, BBC AMERICA (which includes U.S. distribution and sales responsibilities for BBC News), IFC, SundanceTV and We TV; and film distribution labels Independent Film Company and RLJE Films. The Company also operates AMC Studios, its in-house studio, production and distribution operation behind acclaimed and fan-favorite original franchises including The Walking Dead Universe and the Anne Rice Immortal Universe; and AMC Networks International, its international programming business.