Financial Highlights:

- Net revenues of $772 million

- Operating income of $170 million; Adjusted Operating Income1 of $232 million

- Diluted EPS of $2.25; Adjusted EPS1 of $2.60

- Cash Provided by Operating Activities of $289 million and Free Cash Flow1 of $229 million for the six months ended June 30, 2019

- 1 million shares repurchased for $57 million in second quarter 2019

Operational Highlights:

- The Company announced the expansion of The Walking Dead franchise via an agreement with Universal Studios for the theatrical release of a feature film starring Andrew Lincoln as Rick Grimes

- The Company received 26 Emmy Nominations across its portfolio of brands, including 9 nominations for AMC’s Better Call Saul and 9 nominations for BBCA’s Killing Eve, reflecting its continued content creation success

- The Company successfully completed the advertising upfront, including achieving double-digit CPM gains at AMC led by strong demand for its original programming

- The Company continued to make significant progress on its direct-to-consumer services Acorn TV, Shudder, UMC and Sundance Now, including impressive year-over-year growth in revenues and subscribers

New York, NY – July 31, 2019: AMC Networks Inc. (“AMC Networks” or the “Company”) (NASDAQ: AMCX) today reported financial results for the second quarter ended June 30, 2019.

President and Chief Executive Officer Josh Sapan said: “We delivered solid results in the second quarter and remain on track to deliver on our financial targets for the full year. We continue to make significant progress on our strategic goals, which include creating great content and diversifying our revenue. Our recently announced landmark partnership with Universal Studios for the first-ever theatrical movie set in The Walking Dead Universe underscores the high level of interest that the universe commands and the undeniable strength and vitality of this growing franchise. The recent Emmy nominations brought AMC Networks wide recognition, with nominations for four of our five networks as well as our streaming service Acorn TV, affirming AMC Networks as a company whose shows ignite audiences, critics and Emmy voters at a time that is more crowded and competitive than ever.”

Added Sapan: “In addition, we are seeing very healthy rates of growth across our four targeted SVOD services – Acorn TV, Shudder, Sundance Now, and UMC. As these services gain sufficient scale, we have been increasingly populating them with original content, which has been resonating with subscribers and is driving our momentum. As we continue to remain focused on creating sought-after premium content – which propels our entire enterprise – we believe direct-to-consumer, along with owning more of our intellectual property and expanding our studio, represent significant growth areas for us.”

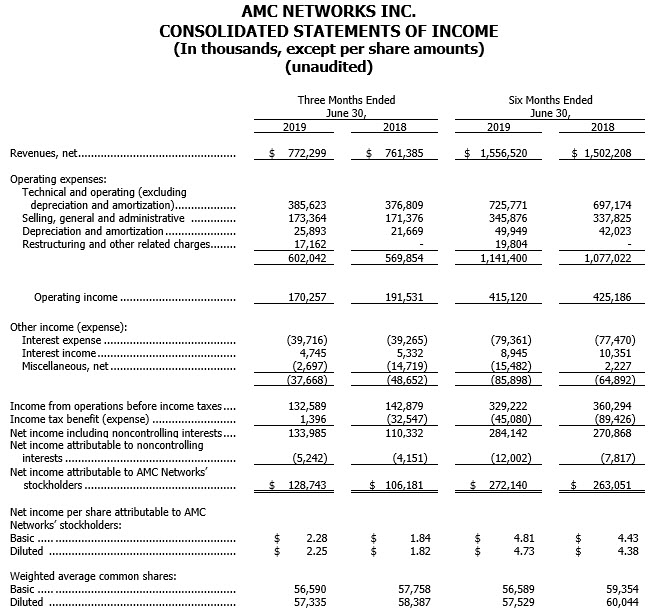

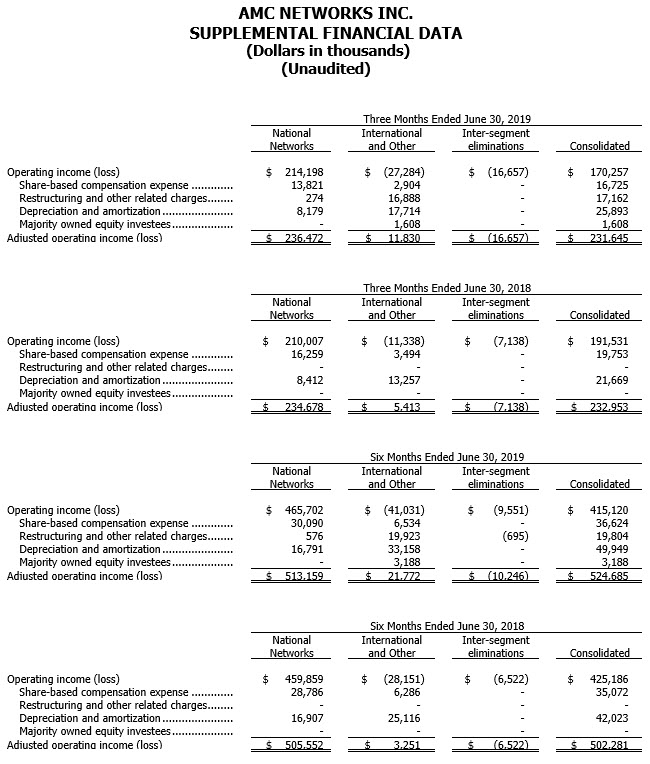

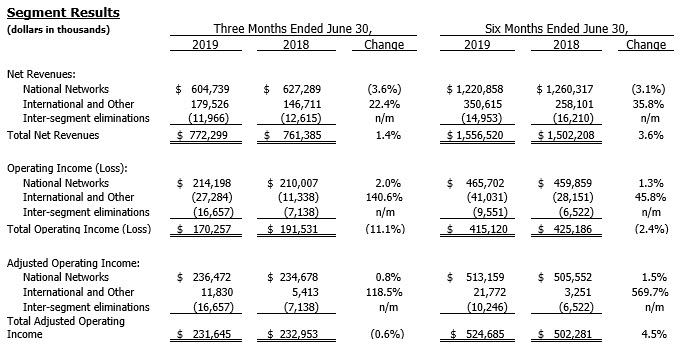

Second quarter net revenues increased 1.4%, or $11 million, to $772 million over the second quarter of 2018. The increase in net revenues reflected an increase of 22.4% at International and Other and a decrease of 3.6% at National Networks. Operating income was $170 million, a decrease of 11.1%, or $21 million, versus the prior year period. The operating income decrease reflected an increase of 2.0% at National Networks offset by an increase of $16 million in operating loss at International and Other. The increase in operating loss at International and Other was primarily related to $17 million in restructuring and other related charges incurred in the second quarter principally related to a reorganization of the Company’s direct-to-consumer businesses. Adjusted Operating Income2 was $232 million, a decrease of 0.6%, or $1 million, versus the prior year period. The decrease in adjusted operating income reflected an increase of 0.8% at National Networks and an increase of $6 million at International and Other offset by an increase of $10 million in Inter-segment eliminations versus the prior year period. As discussed in the “Other Matters” section of the release, results include the impact of the acquisition of RLJ Entertainment (“RLJE”).

For the six months ended June 30, 2019, net revenues increased 3.6%, or $54 million, to $1.557 billion, operating income decreased 2.4%, or $10 million, to $415 million, and adjusted operating income increased 4.5%, or $22 million, to $525 million.

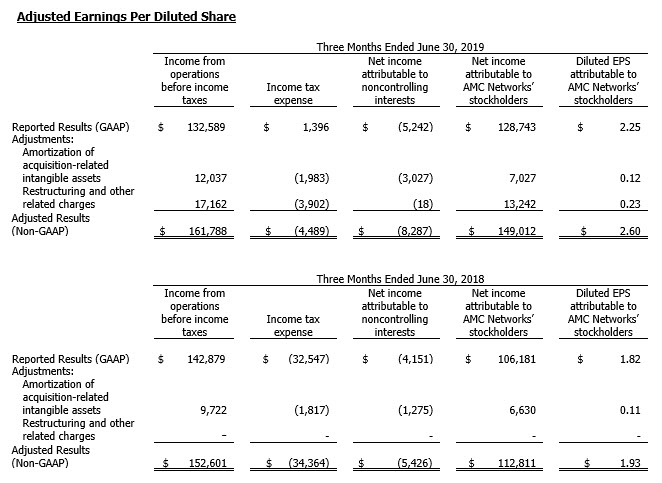

Second quarter net income was $129 million ($2.25 per diluted share), compared with $106 million ($1.82 per diluted share) in the prior year period. EPS primarily reflected a decrease in income tax expense as well as a decrease in miscellaneous, net expense partially offset by an increase in restructuring and other related charges. Second quarter Adjusted EPS2 was $149 million ($2.60 per diluted share), compared with $113 million ($1.93 per diluted share) in the prior year period. The increase in adjusted EPS was primarily related to a decrease in income tax expense and a decrease in miscellaneous, net expense.

Net income for the six months ended June 30, 2019 was $272 million ($4.73 per diluted share), compared with $263 million ($4.38 per diluted share) in the prior year period. Adjusted EPS for the six months ended June 30, 2019 was $301 million ($5.24 per diluted share), compared with $276 million ($4.60 per diluted share) in the prior year period.

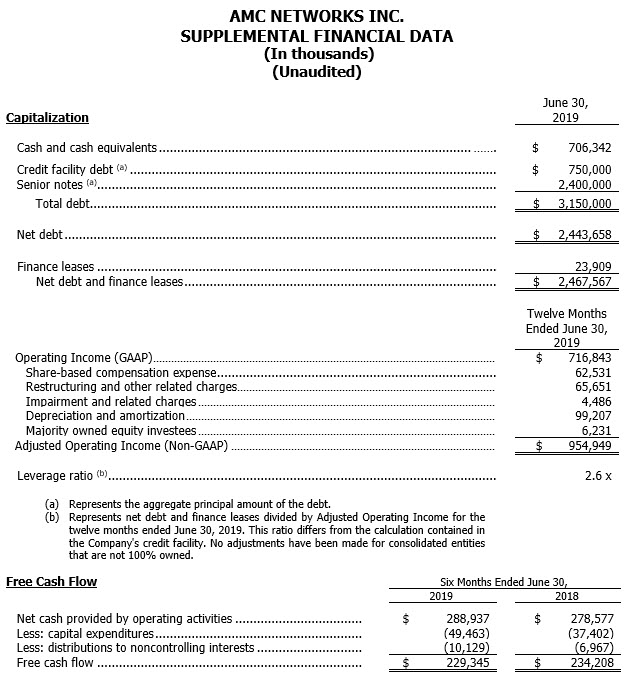

For the six months ended June 30, 2019, net cash provided by operating activities was $289 million, an increase of $10 million versus the prior year period. The increase was primarily the result of an increase in adjusted operating income as well as a decrease in working capital partially offset by an increase in tax payments. Free Cash Flow2 for the six months ended June 30, 2019 was $229 million, a decrease of $5 million versus the prior year period. The decrease primarily reflects the increase in net cash provided by operating activities offset by an increase in capital expenditures and distributions to noncontrolling interests.

National Networks

National Networks principally consists of the Company’s five nationally distributed programming networks, AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business.

National Networks revenues for the second quarter 2019 decreased 3.6% to $605 million, operating income increased 2.0% to $214 million, and adjusted operating income increased 0.8% to $236 million, all compared to the prior year period.

National Networks revenues for the six months ended June 30, 2019 decreased 3.1% to $1.221 billion, operating income increased 1.3% to $466 million, and adjusted operating income increased 1.5% to $513 million, all compared to the prior year period.

Second quarter revenues reflected a 1.3% increase in distribution revenues to $385 million. The increase in distribution revenues was attributable to an increase in content licensing revenues. Advertising revenues decreased 11.1% to $219 million. The decrease in advertising revenues primarily related to the timing of the airing of original programming as well as lower delivery partially offset by higher pricing.

Second quarter operating income and adjusted operating income reflected a decrease in operating expenses partially offset by the decrease in revenues. The decrease in operating expenses was primarily attributable to lower programming and marketing expenses. Programming expenses included charges of $10 million in the current year period related to the write-off of programming assets, as compared to charges of $4 million in the prior year period. Operating income also reflected a decrease in share-based compensation expense.

International and Other

International and Other principally consists of AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; Levity Entertainment Group, the Company’s production services and comedy venues business; RLJ Entertainment, a content distribution company that also includes the subscription streaming services Acorn TV and Urban Movie Channel; and the Company’s wholly-owned subscription streaming services, Shudder and Sundance Now.

International and Other revenues for the second quarter of 2019 increased 22.4% to $180 million, operating loss increased $16 million to a loss of $27 million, and adjusted operating income increased $6 million to $12 million, all compared to the prior year period.

International and Other revenues for the six months ended June 30, 2019 increased 35.8% to $351 million, operating loss increased $13 million to a loss of $41 million, and adjusted operating income increased $19 million to $22 million, all compared to the prior year period.

Second quarter revenues primarily reflected $26 million related to the acquisition of RLJE.

Second quarter operating loss and adjusted operating income reflected the increase in revenues as well as an increase in operating expenses. The increase in operating expenses were primarily attributable to the acquisition of RLJE. Operating loss also reflects restructuring and other related charges of $17 million recorded in connection with the reorganization of the direct-to-consumer businesses.

Other Matters

Stock Repurchase Program

As previously disclosed, the Company’s Board of Directors authorized a program to repurchase up to $1.5 billion of its outstanding shares of common stock. The Company will determine the timing and the amount of any repurchases based on its evaluation of market conditions, share price, and other factors. The stock repurchase program has no pre-established closing date and may be suspended or discontinued at any time. During the second quarter, the Company repurchased approximately 1.1 million shares for $57 million. From July 1, 2019 through July 26, 2019, the Company repurchased approximately 115,000 additional shares for $6 million. As of July 26, 2019, the Company had $495 million available under its stock repurchase authorization.

RLJ Entertainment, Inc.

As previously disclosed, in October 2018, the Company acquired a controlling interest in RLJ Entertainment, Inc. (“RLJE”). During the second quarter, the Company recorded net revenues, operating loss and AOI of $26 million, $2 million and $2 million, respectively, related to RLJE. For the six months ended June 30, 2019, the Company recorded net revenues, operating loss and AOI of $48 million, $5 million and $2 million, respectively, related to RLJE.

Adjusted Operating Income

As previously disclosed, in connection with the acquisition of RLJE, the Company acquired RLJE’s 64% interest in Agatha Christie Limited (“ACL”), which manages the intellectual property and publishing rights based on the author’s works. The Company records its interest in ACL under the equity method as a component of Miscellaneous, Net. As a result of the RLJE acquisition, the Company modified its definition of Adjusted Operating Income to include majority owned (>50%) equity investees. For the second quarter, the Company recorded adjusted operating income of $2 million related to ACL. For the six months ended June 30, 2019, the Company recorded adjusted operating income of $3 million related to ACL.

Please see the Company’s Form 10-Q for the period ended June 30, 2019 for further details regarding the above matters.

Description of Non-GAAP Measures

The Company defines Adjusted Operating Income (Loss), which is a non-GAAP financial measure, as operating income (loss) before depreciation and amortization, share-based compensation expense or benefit, impairment and related charges (including gains or losses on sales or dispositions of businesses), restructuring and other related charges, and the Company’s proportionate share of adjusted operating income (loss) from greater than 50% owned equity method investees. Because it is based upon operating income (loss), Adjusted Operating Income (Loss) also excludes interest expense (including cash interest expense) and other non-operating income and expense items. The Company believes that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of the various operating units of the business without regard to the effect of the settlement of an obligation that is not expected to be made in cash.

The Company believes that Adjusted Operating Income (Loss) is an appropriate measure for evaluating the operating performance of the business segments and the Company on a consolidated basis. Adjusted Operating Income (Loss) and similar measures with similar titles are common performance measures used by investors, analysts and peers to compare performance in the industry.

Internally, the Company uses net revenues and Adjusted Operating Income (Loss) measures as the most important indicators of its business performance, and evaluates management’s effectiveness with specific reference to these indicators. Adjusted Operating Income (Loss) should be viewed as a supplement to and not a substitute for operating income (loss), net income (loss), and other measures of performance presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Since Adjusted Operating Income (Loss) is not a measure of performance calculated in accordance with GAAP, this measure may not be comparable to similar measures with similar titles used by other companies. For a reconciliation of Adjusted Operating Income (Loss) to operating income (loss), please see page 8 of this release.

The Company defines Free Cash Flow (“Free Cash Flow”), which is a non-GAAP financial measure, as net cash provided by operating activities less capital expenditures and cash distributions to noncontrolling interests, all of which are reported in our Consolidated Statement of Cash Flows. The Company believes the most comparable GAAP financial measure of its liquidity is net cash provided by operating activities. The Company believes that Free Cash Flow is useful as an indicator of its overall liquidity, as the amount of Free Cash Flow generated in any period is representative of cash that is available for debt repayment, investment, and other discretionary and non-discretionary cash uses. The Company also believes that Free Cash Flow is one of several benchmarks used by analysts and investors who follow the industry for comparison of its liquidity with other companies in the industry, although the Company’s measure of Free Cash Flow may not be directly comparable to similar measures reported by other companies. For a reconciliation of Free Cash Flow to net cash provided by operating activities, please see page 9 of this release.

The Company defines Adjusted Earnings per Diluted Share (“Adjusted EPS”), which is a non-GAAP financial measure, as earnings per diluted share excluding the following items: amortization of acquisition-related intangible assets; impairment and related charges (including gains or losses on sales or dispositions of businesses); non-cash impairments of goodwill, intangible and fixed assets; restructuring and other related charges; and gains and losses related to the extinguishment of debt; as well as the impact of taxes on the aforementioned items. The Company believes the most comparable GAAP financial measure is earnings per diluted share. The Company believes that Adjusted EPS is one of several benchmarks used by analysts and investors who follow the industry for comparison of its performance with other companies in the industry, although the Company’s measure of Adjusted EPS may not be directly comparable to similar measures reported by other companies. For a reconciliation of Adjusted EPS to earnings per diluted share, please see pages 10-11 of this release.

Forward-Looking Statements

This earnings release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results or developments may differ materially from those in the forward-looking statements as a result of various factors, including financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industries in which it operates and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

Conference Call Information

AMC Networks will host a conference call today at 8:30 a.m. ET to discuss its second quarter 2019 results. To listen to the call, visit http://www.amcnetworks.com or dial 877-347-9170, using the following passcode: 7177323.

About AMC Networks Inc.

AMC Networks owns and operates several of cable television’s most recognized brands delivering high quality content to audiences and a valuable platform to distributors and advertisers. The Company manages its business through two operating segments: (i) National Networks, which principally includes AMC, WE tv, BBC AMERICA, IFC and SundanceTV; and AMC Studios, the Company’s television production business; and (ii) International and Other, which principally includes AMC Networks International, the Company’s international programming business; IFC Films, the Company’s independent film distribution business; Levity Entertainment Group, the Company’s production services and comedy venues business; RLJ Entertainment, a content distribution company that also includes the subscription streaming services Acorn TV and Urban Movie Channel; and the Company’s wholly-owned subscription streaming services, Shudder and Sundance Now. For more information on AMC Networks, please visit the Company’s website at http://www.amcnetworks.com.